- The SPAC and IPO market is heading for another robust year, which means opportunity for PR firms.

- Companies going public need seasoned communications vets to help put their businesses in the best light for investors.

- Insider identified the top 18 public relations pros working in IPOs and SPACs today.

- See more stories on Insider’s business page.

2020 was a robust year for companies going public through IPOs and SPACs, and 2021 is already looking to bring more of the same.

SPACs, or special purpose acquisition companies, allow companies to go public outside the traditional IPO process.

The increase in SPACs and traditional IPOs could be lucrative for the PR industry as target companies, which often don’t have their own investors relations division, call on public relations pros to put their business model in the best light.

ICR CEO Tom Ryan said that his firm’s annual revenue increased by 20% year-over-year to $106 million in 2020 due to its work on SPACs. One of the best known IPO players, ICR advised on more than 50 SPAC deals in 2020, equivalent to about 20% of the total market.

Companies going public also have to adhere to financial and information disclosure rules imposed by regulators like the Securities and Exchange Commission. That means PR pros have to vet all information disclosed by a company going public.

The growing popularity of SPACs as a new investment opportunity prompted the SEC to caution investors from jumping on the bandwagon “based solely on a celebrity’s involvement or based solely on other information you receive” through outlets like social media and newspapers.

Insider identified the top 18 PR pros that work in-house or at firms based on original reporting, publicly available information, and nominations.

The list includes well-known figures like Sard Verbinnen’s co-president Paul Kranhold — known for working on Alibaba and Snap’s IPOs — and newcomers like Mustafa Riffat, an Edelman EVP who previously worked on the Alibaba and ARAMCO IPOs.

John Christiansen, managing director, Sard Verbinnen & Co.

Co-head of Sard Verbinnen’s West Coast offices, Christiansen oversees 45 staffers and has led work on a number of high-profile IPOs.

Christiansen advised on Slack’s direct listing and Uber’s IPO in 2019 and is also working on real estate company Compass’ closely watched forthcoming IPO.

He’s advised Virgin Galactic, Luminar, 23andMe, and Matterport during their SPAC mergers and is working with Gores Group and Oaktree Capital on their SPACs.

Moira Conlon, founder and president, Financial Profiles

Conlon founded Financial Profiles in 2007 and has worked on a number of SPACs and IPOs for companies like electronic vehicle charging network ChargePoint and AEye, whose tech supports autonomous vehicles and driver assistance systems. Those transactions were valued at $2.4 billion and $2 billion, respectively.

Financial Profiles is composed of former Wall Street analysts and financial reporters in addition to PR pros and does work on spin-offs, mergers and acquisitions, and other deals. It’s handled SPAC work since 2009, starting with Two Harbors Investment Corp.

Before Financial Profiles, Conlon worked for 13 years at MWW-owned Financial Relations Board and at Merrill Lynch’s investment banking division and mortgage and money markets origination group. She also had a stint at Abernathy MacGregor.

Keyana Corliss, head of global corporate communications, Databricks

Corliss leads communications at Databricks as the data and AI company explores its options to go public later this year.

Corliss has gotten coverage for Databrick’s Series G funding round in CNBC, Forbes, and other publications as well as its partnership with Google Cloud, which was covered by outlets like CNBC and TechCrunch.

Before Databricks, Corliss led global PR and executive communications for Tableau, the data visualization company acquired by Salesforce in 2019. At Merritt Group, Corliss helped Tableau go public in 2013 when it raised $254 million.

Corliss got widespread coverage for Tableau in the lead-up to and day of its IPO.

Don Duffy, president, ICR

Duffy oversees all SPAC accounts at the firm and has advised clients on more than 250 IPOs, SPACs, and direct listings in the past 10 years, including high-profile IPOs for clients like Visa, which raised $17.9 billion and Shake Shack, which raised $1.6 billion.

From January 2020 to March, ICR has advised on more than 80 SPACs, including Paysafe, Hostess, DraftKings, and QuantumScape, collectively raising more than $100 billion in capital.

Duffy advised on ICR’s first SPAC transaction when smoothie company Jamba Juice went public in 2007.

Bob East, managing partner and co-head of ICR's healthcare practice, ICR Westwicke

East has led communications and investor relations work for dozens of IPOs and SPACs over the past three years.

He joined ICR in 2019 after it acquired Westwicke Partners, a healthcare investor relations firm that East founded in 2006.

East and his team have since doubled Westwicke’s annual revenue to more than $20 million in 2020.

East draws on his background as a Deutsche Bank vet to counsel clients going through the SPAC process, like health and wellness company Sharecare, telemedicine company Hims & Hers, and online therapy provider Talkspace — valued at $3.9 billion, $1.6 billion, and $1.4 billion, respectively. He’s also advised on IPOs for telehealth giant Amwell, primary-care startup Oak Street.

In addition, East has worked for SPACs like Longview Capital when it acquired Butterfly, as well as Organogenesis and Gig Capital’s combined acquisition of UpHealth and Cloudbreak.

Jeff Fox, director, The Blueshirt Group

At Blueshirt, a financial communications firm focused on tech, Fox counsels clients during key financial milestones, including IPOs.

In the past year, Fox led work on healthcare company GoodRx’s IPO, streaming company FuboTV, and lending company Upstart.

He’s also been key Blueshirt’s other big accounts like productivity software provider Asana’s direct listing and fintech startup SoFi’s forthcoming SPAC IPO.

Nathanial Garnick, managing director, Gasthalter & Co.

Garnick joined Gasthalter & Co. from Sard Verbinnen & Co. when the boutique shop launched in 2016.

Since then, Garnick has advised on more than 15 SPAC IPOs that collectively raised more than $7 billion in capital. The mergers from these SPACs total more than $34 billion in market value.

His notable assignments include Social Capital Hedosophia’s merger with SoFi, Northern Star’s mergers with BARK and Apex Clearing, Vector Acquisition Corp.’s merger with Rocket Lab USA, and Fortress Value Acquisition Corp.’s merger with MP Materials.

Kim Hughes, managing director and co-lead of strategic media, The Blueshirt Group

Hughes has helped The Blueshirt Group become one of the best known financial communications firms helping tech companies go public.

She’s worked on transactions like productivity company Asana’s direct listing, personal finance startup SoFi’s SPAC IPO and telemedicine platform GoodRx’s traditional IPO.

Her past work also includes IPOs for business spend management company Coupa, freelance services company Fiverr, and event management and ticketing company Eventbrite.

Jenna Kozel, VP of corporate communications and content marketing, Okta

One of Kozel’s biggest career moments was in 2017 when identity management software company Okta went public through an IPO that raised $187 million.

Her communications and media efforts led to 92 articles in places like The Wall Street Journal, CNBC, and the Financial Times, Kozel said.

Kozel previously was at Edelman for eight years, where she worked on accounts like AMD, Adobe, and Juniper Networks.

Paul Kranhold, co-president, Sard Verbinnen & Co.

Kranhold has helped the financial and crisis communications giant power come back after a third of its partners left following its stake sale to private equity firm Golden Gate Capital in 2016.

His wins include IPO work like Compass and Ant Financial — the latter of which is expected to shatter records once it receives approval from Chinese regulators. Kranhold also advised on Alibaba and Snap’s IPOs.

When it comes to SPACs, Kranhold has helped 23andMe tell its story as the consumer genetic-testing company prepares to go public; worked on SPACs for SoftBank Group; and advised an investor in Blue Owl’s SPAC.

Mylene Mangalindan, partner, Brunswick Group

The former Bloomberg and Wall Street Journal reporter has worked six years at Brunswick Group, helping lead some of the agency’s most high-profile work.

Most recently, Mangalindan helped run communications for Roblox’s direct listing on the New York Stock Exchange in March 2021. She also worked on communications for Fisker Inc. as the company merged with a SPAC in a deal that valued the electric car maker at $2.9 billion.

Mangalindan also worked on traditional IPOs like Pinterest’s in 2019 and SurveyMonkey in 2018.

Darren McDermott, partner, Brunswick Group

The former Wall Street Journal reporter has used his communications skills to win new accounts for Brunswick Group since he joined in 2012.

McDermott helped Spotify when the music streamer opted for a direct listing instead of doing an IPO in 2019, an unusual move at the time. He also worked on Roblox’s direct listing in March 2021.

He’s also handled traditional IPOs for tech companies like Airbnb, Doordash, and Pinterest, and is currently working for Coinbase, which has a $100 billion valuation, as the crypto exchange prepares to go public.

Ted McHugh, EVP, head of investor relations, Edelman

McHugh, who leads Edelman’s investor relations practice, has helped build an 18-person team for IPOs and SPACs as the agency tries to broaden its work beyond consumer goods clients it’s best known for.

McHugh led financial communications on IPOs for companies like online mortgage provider Rocket Companies, AI company C3.Ai’s, and luxury ecommerce site Mytheresa. He also supported the financial communications team when health insurer Oscar Health went public.

McHugh and his team also led the recent SPAC deal between Victory Park Acquisition Corp and Bakkt and continue to advise Bakkt.

Nicole Phelan, chief of staff, VP of marketing and communications, Luminar Technologies

Phelan oversaw communications and marketing for Luminar as the autonomous vehicle technology company formally launched in 2017 and went public through a $3.4 billion SPAC merger.

She coached 25-year-old CEO Austin Russell for interviews with the likes of NPR, The Wall Street Journal, CNBC Squawk Box, and others.

Her press efforts helped Luminar get widespread media coverage the day it debuted on the Nasdaq.

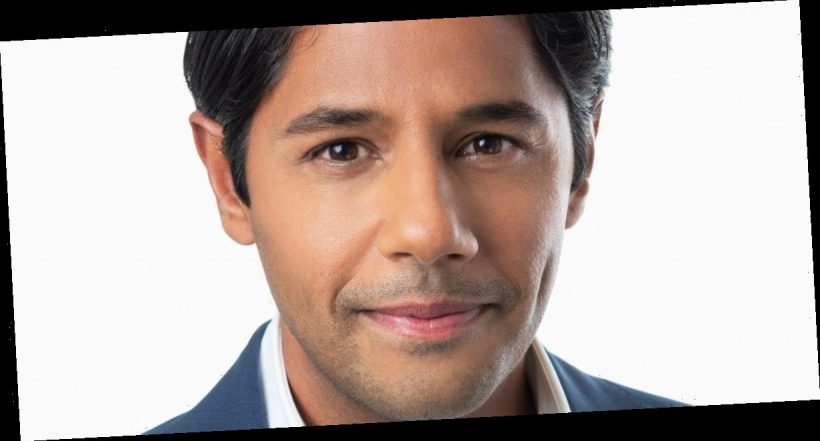

Mustafa Riffat, EVP, Edelman

Riffat is helping the world’s largest PR firm compete with more entrenched players like Joele Frank and Sard Verbinnen & Co.

Hired in 2020, Riffat advised ZoomInfo when it went public as the first tech IPO during the pandemic, netting the Saas company $900 million, as well as SPAC deals like trucking tech company Hyliion’s merger with Tortoise.

Before joining Edelman, Riffat worked at Brunswick Group, where he worked on two of the world’s largest IPOs in the world: Saudi Aramco when it started trading on the Saudi Stock Exchange in 2019, raising $29.4 billion, and Alibaba’s $21.8 billion blockbuster IPO when it debuted on the New York Stock Exchange in 2014.

Ash Spiegelberg, partner and head of the San Francisco office, Brunswick Group

Brunswick Group’s San Francisco office head made a name for himself working on high-profile IPOs like DoorDash, Airbnb, and Pinterest.

Spiegelberg has continued his streak this year, leading work on mega IPO South Korean ecommerce giant Coupang.

He’s also leading work on Coinbase’s direct listing on the Nasdaq, one of the largest cryptocurrency exchanges that’s reportedly valued at more than $100 billion.

Sheila Tran, head of communications, Opendoor

Tran coordinated comms across external PR, internal communications, and investor relations for Softbank-backed Opendoor as the online real estate company went public through a merger with Social Capital Hedosophia Holdings Corp II, a SPAC led by venture-capitalist Chamath Palihapitiya.

When CEO Eric Wu appeared on CNBC, Tran prepped him for the interview to set the narrative. Wu credited Tran with helping turn that merger into a success when it was completed in October 2020.

Tran is a longtime veteran of the tech industry; she headed global communications and PR at Yahoo when it was acquired by Verizon.

David Wells, partner, Prosek Partners

Wells is helping Prosek, best known for consumer-facing PR and marketing for financial services companies, expand its financial communications by doing more transaction work.

For example, Wells and his team have worked on more than a dozen SPACs, including D and Z Media, one of the few woman-led SPACs, which is seeking a company to merge with.

Wells was tapped to advise Dyal Capital and Owl Rock when they decided to combine in 2021 through a SPAC merger. The plan is to create an entity called Blue Owl Capital with a $12.5 billion market cap.

Source: Read Full Article