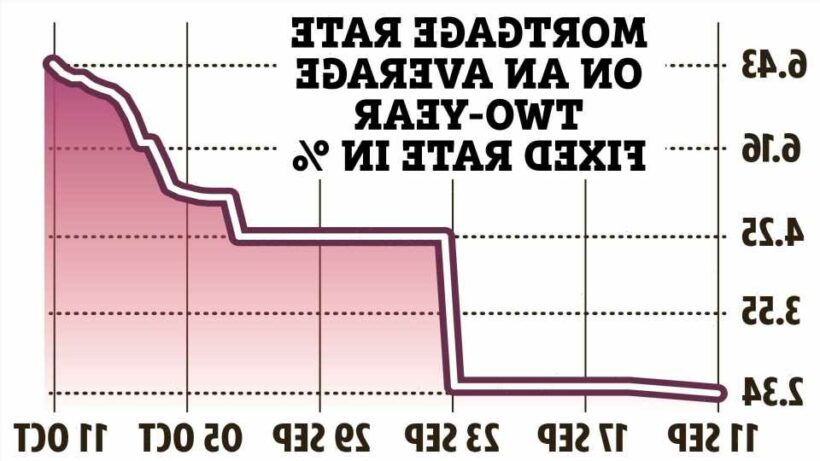

MORTGAGE rates have surpassed 6.4% and homebuyers are in for a bumpy ride.

Mortgage rates shot up to their highest levels in 14 years after the pound tumbled last night.

This will add an extra £5,000 to annual interest payments for the average household with a two-year fix on a £200,000 mortgage.

And the Bank of England has warned that if rates continue to rise, the number of households struggling to pay will reach levels not seen since the 2008 global financial crisis.

The pound plunged against the dollar last night, dropping below $1.10 for the first time in weeks – from 1.1178 to 1.0953.

It tumbled after the Bank of England boss Andrew Bailey said the central bank will stop its government bond purchase programme on Friday, October 14 – which has somewhat stabilised the market in recent days.

READ MORE IN MONEY

Mortgage warning as BoE says millions will struggle at level not seen since 2008

Mortgage rates rise & pound & pension funds hit as BoE steps in again

However, mortgage repayments were already rising due to higher interest rates aimed at combatting inflation.

The fallout from Chancellor Kwasi Kwarteng’s mini-Budget spooked markets further – triggering the sale of bonds.

And this triggered the BoE to step in to stop pension funds from collapsing by buying government bonds in the aftermath of the mini-Budget.

The mini-Budget also caused lenders to pull over a thousand of fixed-rate deals over fears about the cost of borrowing.

Most read in The Sun

I'm A Celeb bosses sign up first ever Royal Family member in Mike Tindall

B&M shoppers are rushing for 'stunning' Christmas items they 'need' to buy

Martine McCutcheon's brother dies ‘suddenly’ aged 31 weeks before wedding

MAFS star Tayah gives birth to first baby with Adam and reveals cute name

And average rates now sit above 6% on two-year and five-year fixed deals for the first time in 14 years — and experts say there are likely to be further increases.

This raises questions such as whether you should pay a charge to get out of your existing deal now and sign up to a new fixed-rate mortgage before the rate climbs even higher.

The Sun’s Head of Consumer gives her expert advice below.

What should I do now?

Double check what type of mortgage you have — fixed or variable? — what your rate is, when the deal finishes and what the penalty might be to leave early.

If you are on a fixed deal, work out when your bills will start rising and by how much.

For example, consider someone who took out a £200,000, two-year fixed mortgage in December 2021 over a 25-year term and is paying 2.34 per cent.

They will pay £420 a month extra when their fixed term ends in December 2023, according to Moneyfacts.

Is it worth paying a penalty to get out of my existing deal?

Many lenders will let you lock into an offer three to six months before your current deal ends.

It is worth doing your sums either way, but Nick Morrey, technical director at mortgage brokers Coreco, says: “It’s not an easy calculation.”

If you are considering leaving your current deal early, you will have to factor in any early repayment charge, plus any fee for taking out a new mortgage.

And that’s before you start comparing the rate of your existing mortgage with a new one.

A good starting point to help you do the sums is MoneySavingExpert’s Ditch Your Fix calculator (bit.ly/3T2QEm1).

What’s better, a fixed or variable deal?

Everyone needs to consider their own personal circumstances to find the best mortgage to meet their needs.

Variable and tracker mortgages may currently look cheaper than a fixed-rate deal, but they will rise if — or more likely when — the base rate goes up again next month.

Those who value the security of knowing how much they will be paying each month should opt for a fixed rate.

Mortgages can be confusing but a broker can help you navigate the maze.

They may earn commission from lenders after arranging a mortgage, and some will also charge you a fee, which will either be a flat rate or a percentage of the amount you want to borrow.

Make sure you speak to a whole-of-the-market broker, so they can access all the deals available, not just a selected few.

You should always check that your broker is authorised to give mortgage advice by consulting the Financial Services Register.

Should I plough my rainy day fund into reducing my mortgage?

Check what fees or penalties you may face for paying extra off your mortgage.

Many lenders let you overpay ten per cent of the balance each year without penalty and paying off that bit extra could bring your payments and interest down.

But before you plough money into your mortgage, make sure you pay off more expensive debts, such as credit cards, and have enough money set aside to pay three to six months’ worth of essential bills.

I’m a first-time buyer, what should I do?

It can seem an especially scary time to take that first leap into home ownership, even with the threshold for paying stamp duty for first-time buyers now £425,000.

But that does not automatically mean that buying a house is off the cards.

Nick says that waiting in case property prices fall is not necessarily a smart move.

He adds: “My advice to first-time buyers is if you are in a position to buy and you can afford the mortgage and you are not planning on selling it in the near future, you should strongly consider going ahead.”

What should I do if I am struggling to pay my mortgage?

Get in contact with your lender.

Read More on The Sun

Workers set for £330 a year pay boost after MPs voted to reverse tax laws

Full list of places kids can eat for free or cheap for October half term

Nick says: “They have a duty of care to make sure you are aware of what your options are and to take steps to try to assist you where they can.”

You can also get free one-to-one debt counselling help from Citizens Advice, StepChange or National Debtline.

Source: Read Full Article