French media giant Vivendi has confirmed it is in talks to sell a 10% stake in Universal Music Group to hedge fund billionaire Bill Ackman’s Pershing Square Tontine Holdings in a deal that values the music company at €35 billion ($42B).

The transaction is subject to approval from Vivendi shareholders. It comes ahead of Vivendi’s plans to list Universal Music Group in Amsterdam, the Netherlands, in late September, when 60% of Universal’s shares will be distributed to Vivendi investors.

If the Pershing Square Tontine Holdings is completed, the Special Purpose Acquisition Company (SPAC), will hold 10% of Universal Music Group, while Vivendi will also have a 10% holding. The remaining 20% of Universal Music Group is owned by Chinese tech giant Tencent.

Vivendi said in a statement: “Vivendi and Pershing Square Tontine Holdings, Ltd. (PSTH), represented by Chief Executive Officer Bill Ackman, have entered into discussions for Vivendi to sell 10% of the Universal Music Group (UMG BV) share capital to PSTH, prior to the distribution of 60% of the UMG shares and its listing.

“This transaction would be based on an enterprise value of €35 billion for 100% of the UMG BV share capital, subject to the authorization given by Vivendi shareholders at the June 22, 2021 Shareholders’ Meeting, to distribute 60% of the UMG share capital and list the company.”

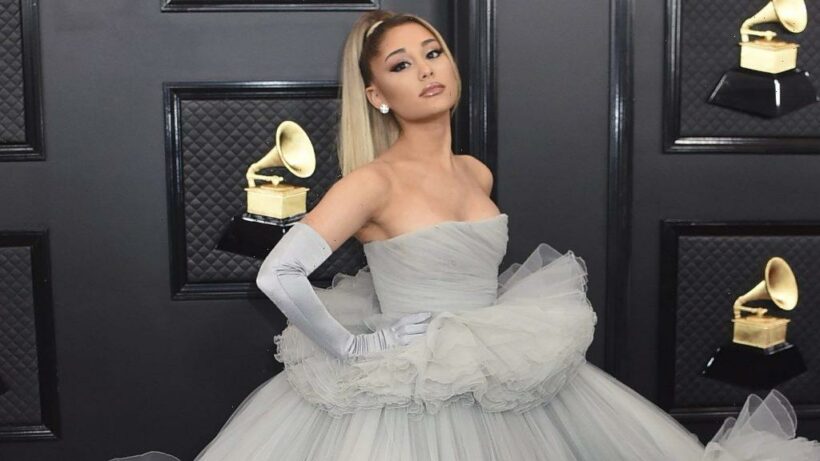

Universal operates labels responsible for artists including Ariana Grande, The Beatles, Taylor Swift, Billie Eilish, and Nirvana.

Read More About:

Source: Read Full Article