WAGES are rising at a record rate for millions of workers as unemployment also falls.

Official figures released today by the Office for National Statistics (ONS) has revealed that basic pay is growing at its fastest rate on record.

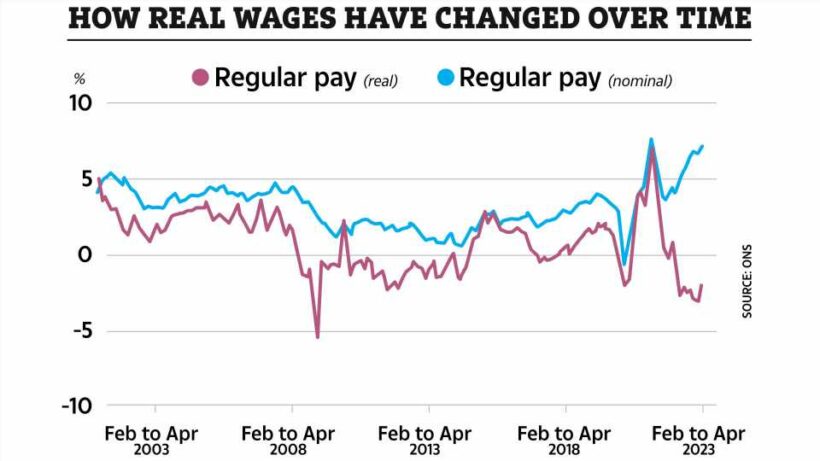

Growth in average total pay, including bonuses, was 6.5% and growth in regular pay, excluding bonuses, was 7.2% among employees in February to April 2023.

Average weekly earnings were estimated at £648 for total pay and £603 for regular pay in April.

Darren Morgan, director of economic statistics at the ONS, said: "In cash terms, basic pay is now growing at its fastest since current records began, apart from the period when the figures were distorted by the pandemic.

“However, even so, wage rises continue to lag behind inflation.”

READ MORE IN MONEY

What is inflation and what is the current rate?

UK inflation rate drops to 8.7% after record highs – what it means for you

The UK's rate of inflation remains high at 8.7% and it's eating into household incomes.

In real terms, adjusted for inflation, growth in total and regular pay fell on the year in February to April 2023, by 2% for total pay and by 1.3% for regular pay.

That means people's pay packets have fallen in real-terms, when factoring in other living costs such as food and energy.

Last month, figures showed that real-terms wages fell by 3%, which means the rate has narrowed slightly.

Most read in Money

Major pharmacy chain to close 237 branches in supermarkets

Thousands warned to look out for letters in weeks – you could get a £3.5k boost

Huge update from HMRC as thousands get extra time to boost payments by £1000s

Little-known way to get free prescriptions – and you could save £115 a year

Meanwhile, the rate of UK unemployment fell to 3.8% in the three months to April from 3.9% in the previous three months, according to the ONS.

Most economists were expecting the unemployment rate to edge up to 4%.

Mr Morgan said: “With another rise in employment, the number of people in work overall has gone past its pre-pandemic level for the first time, setting a new record high, as have total hours worked.

“The biggest driver in recent jobs growth, meanwhile, is health and social care, followed by hospitality.

“While there has been another drop in the number of people neither working nor looking for work, which is now falling right across the age range, those outside the jobs market due to long-term sickness continues to rise, to a new record."

The number of people in jobs at an all-time high of 33.1 million, up 250,000 quarter on quarter as more Britons returned to the jobs market.

Chancellor of the Exchequer Jeremy Hunt said: “The number of people in work has reached a record high, and the IMF and OECD recently credited our major reforms at the Budget which will help even more back into work while growing the economy.

“But rising prices are continuing to eat into people’s pay cheques – so we must stick to our plan to halve inflation this year to boost living standards.”

Plus, 2.6 million people are not working due to long-term health problems, the figures show – up from over 2.5 million last month.

What does it mean for my money?

The main concern when workers see a "real-terms" fall in their salary is that it is not keeping pace with the cost of living.

Alice Haines, personal finance analyst at Bestinvest, said: "With the Bank of England widely expected to increase interest rates by a further 25 basis points when it meets next week, and at least another interest rate rise in the pipeline this year as the central bank battles to bring sticky inflation closer to its 2% target, employers are facing pressure to increase wages at a time when the economic outlook is uncertain.

"This creates a wage-price spiral as rapidly rising pay packets only make it harder for the BoE to bring inflation back under control."

Wage growth is still behind inflation as prices of everything from groceries to energy bills increase at a faster rate.

The average household is forking out £2,500 a year on its energy bills, for example, although this will fall from July 1 to £2,074.

Meanwhile, food prices soared by 19.1% in April, meaning everyday groceries are costing much more.

It means you will be feeling the pinch as your income doesn't go as far and may end up struggling to pay your bills.

What help is available?

If you are struggling there's support on offer.

The Government is handing out three cost of living payments to millions, worth £900, £150-£300 and £150.

To be eligible for the £900 payment, households will need to be claiming at least one of the following:

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Income Support

- Pension Credit

- Tax Credits (Child Tax Credit and Working Tax Credit)

- Housing Benefit

- Council Tax Support

- Social Fund (Sure Start Maternity Grant, Funeral Payment, Cold Weather Payment)

- Universal Credit

The payment has been split into three instalments worth £301, £300 and £299.

The first instalment should have been paid to all eligible people in May while the second and third instalments can be expected in autumn this year and spring 2024.

Elderly Brits will receive another £150-£300 cash boost to their Winter Fuel payment later this year too.

And millions of people with disabilities will get a £150 payment this summer.

You might also be able to get help via the Household Support Fund.

The help is being distributed by councils in England and what you are entitled to varies depending on where you live.

But, in most cases, you will be in line for support if you are on a low income or benefits.

Read more on The Sun

Urgent warning to check sunscreen bottles after woman reveals horror ‘burn’

I’m a fairground whizz – how to win at the games, despite some being rigged

Beyond this, a number of energy suppliers offer grants to customers who are struggling with their bills.

This includes British Gas, EDF, Octopus Energy and Scottish Power.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]

Source: Read Full Article