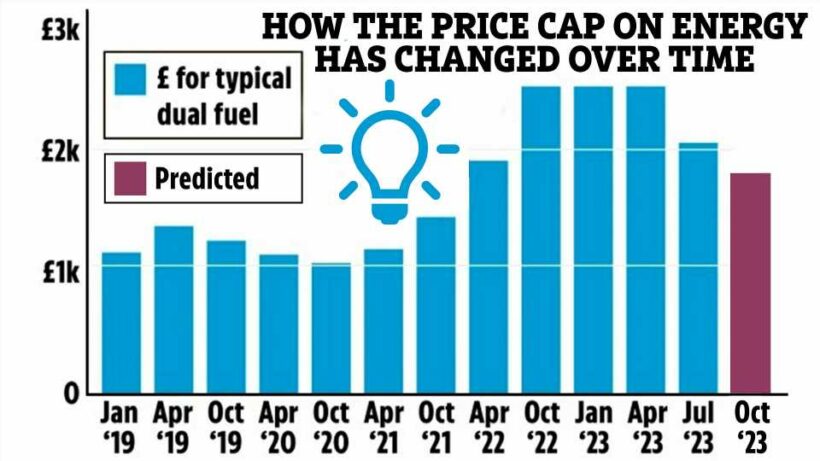

MILLIONS of households are set to see their energy bills fall later this year.

New analysis from consultancy firm Cornwall Insights has predicted a typical dual fuel household will pay £1,860 a year from October 1 under Ofgem's price cap.

Those on dual-fuel tariffs receive their gas and electricity from one supplier.

Households on these tariffs are currently paying £2,074 a year, but the latest predictions would see this figure drop by £214.

It's worth noting Cornwall Insights' figures are just a prediction, so the price cap isn't guaranteed to be £1,860.

Plus, the price cap just sets a limit on what firms can charge customers for each unit of gas and electricity.

Read more in Energy Bills

Shell boss says blackouts unlikely this winter — if weather isn’t cold

Fury as British Gas profits soar by 900% as Brits struggle to pay energy bills

That means you might pay more or less than the predicted £1,860 figure, depending on your usage.

In its latest analysis, Cornwall Insights also predicted energy bills will remain "relatively stable" but above pre-pandemic levels for the foreseeable future.

They also estimated the cap will rise to around £1,960 in January 1, 2024, before further small decreases in March and July 2024.

It comes after the price cap fell from £3,280 to £2,074 on July 1 in a relief to millions of households who have seen prices soar since 2021.

Most read in Money

Major supermarket chain to close several stores in weeks

Shop you've never seen before sells your fav snacks and treats 7 TIMES cheaper

Families to get £94 cost of living payments direct into bank accounts in DAYS

Shop you've never heard of that's better than Poundland and B&M

The jump in prices is partly due to economies emerging from coronavirus lockdowns and Russia's invasion of Ukraine, which saw wholesale prices spike.

However, households were partly shielded after the government introduced the energy price guarantee, which capped bills at £2,500 for the average dual-fuel household.

Craig Lowrey, principal consultant at Cornwall Insight, said: "The news of a relative stabilising of energy bills will no doubt leave households with mixed feelings.

"After the surge in bills seen last winter, it may bring a sense of relief to people that energy prices are currently not forecast to surge unexpectedly.

"However, there will also be disappointment with prices still well above the levels seen a few years ago – leaving many longing for more affordable options.

"The wholesale market remains the main driver of bills, and unfortunately there is no immediate prospect of prices there returning to historic averages."

What is the energy price cap?

The energy price cap sets a limit on the maximum amount suppliers can charge for each unit of gas and electricity.

This means you might end up paying more than the headline price cap figure – that is what the average household will pay.

Depending on your usage, you could end up forking out more or less.

Ofgem also sets a maximum daily standing charge which is what households have to pay in order to have their home connected to the National Grid.

The price cap was introduced in January 2019 and originally updated every six months but is now amended every three months.

That means after the new price cap comes into effect on October 1, the next update will be on January 1, 2024.

The energy price cap only applies to customers on providers' standard tariffs, so if you're on a fixed-term deal you won't be impacted.

A standard tariff means your unit rates and standing charge can increase or decrease at any point.

Fixed-term deals, on the other hand, see your unit rates and standing charge remain the same across your agreed contract term.

Some fixed-term deals have started re-entering the market, with one from So Energy costing £2,047 – £27 less than the current price cap.

But while a fixed-term deal might see you make savings now, it might not further down the line, if prices fall as they are predicted to.

What help you can get with your energy bills

There's a range of support you can get if you're struggling to pay your bills, even after they've fallen.

A number of firms offer grants worth up to £1,500 to customers who can't make repayments.

British Gas, EDF, Scottish Power, E.ON and Octopus Energy all run schemes.

Even if you're not with one of these companies, it's worth contacting your provider to see if they run a similar scheme or can put you on a payment plan.

Meanwhile, you might be able to get help via a Government cost of living payment.

There are three in total, with one £150 payment having already been made.

There is also a £900 payment which has been split into three instalments worth £301, £300 and £299.

Millions are receiving the tax-free cash.

The first instalment has been paid already and the remaining two are set to land in bank accounts this autumn and spring 2024.

You qualify for the payments if you receive any one of the following benefits:

- income-based Jobseeker’s Allowance (JSA)

- income-related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

- Universal Credit

- Child Tax Credit

- Working Tax Credit

Plus, millions of pensioners eligible for the Winter Fuel payment later this year will receive a top-up worth £150-£300.

It's always worth checking if you can claim benefits too. Not only will you get the cash boost, but it might make you eligible for a cost of living payment.

The quickest way to see what benefits you may be able to claim is to use one of the three benefit calculators recommended by Gov.uk.

Each one is free to use. They are:

- Turn2us

- Policy in Practice

- entitledto

If you're on a prepayment meter you might be able to get a one-off voucher to top up.

Read More on The Sun

Holiday warning as tourists face £260 fine for hogging prime beach spaces in Spain

I spent £200k to build amazing tourist attraction but jobsworths are ruining it

Your supplier might add this to your meter automatically when you run out of credit, or you may have to contact them to receive it.

Check in with your energy company about how it works for you.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.

Source: Read Full Article