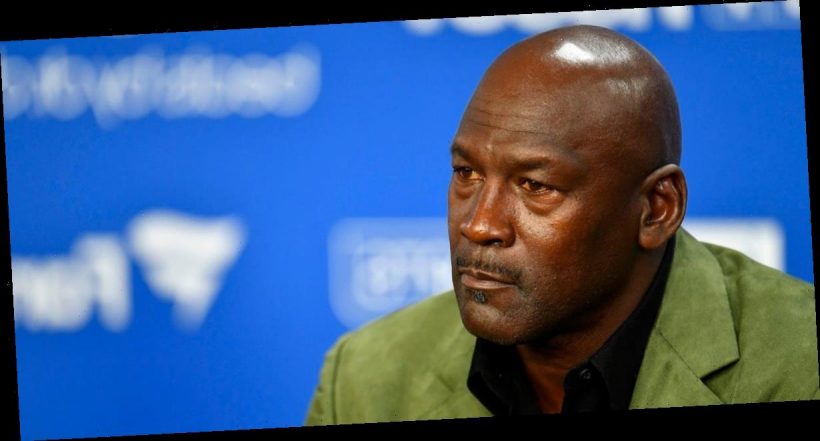

- In 2019, Michael Jordan brought in new investors to the Charlotte Hornets: Gabe Plotkin and Dan Sundheim.

- Plotkin and Sundheim are two of the biggest losers from this week’s short squeeze pitting Redditors against Wall Street.

- The deep-pocketed basketball team backers are taking a major hit at the same time pro sports are reeling.

- Visit Business Insider’s homepage for more stories.

Two years ago, NBA legend and Charlotte Hornets owner Michael Jordan brought in two new investors: hedge fund founders Gabe Plotkin and Dan Sundheim.

Plotkin and Sundheim are now two of the biggest losers from this week’s short squeeze that is pitting Redditors against Wall Street.

So far, the Redditors have been winning. Forums such as WallStreetBets are targeting heavily shorted stocks causing short sellers to lose $5 billion on GameStop shorts alone.

Plotkin’s Melvin Capital is down 30% for the year, and closed its position in GameStop on Tuesday afternoon. In order to weather the storm, has taken a cash infusion of $2.75 billion from Steve Cohen’s Point72 and Ken Griffin’s Citadel Securities.

When reached for comment, a spokesperson for Melvin Capital told Insider that the fund “is focused on generating high-quality, risk-adjusted returns for our investors, and we are appreciative of their support.”

Meanwhile, D1 Capital, the fund founded by Sundheim, who Insider reported was akin to “the LeBron James of investing,” has been taking a beating from its short positions in AMC. The ailing cinema chain’s stock has risen 900% this month. Sources previously told Insider that D1 has taken a roughly 20% loss from bets on AMC and its public-market bets were down closer to 30% by Wednesday.

A spokesperson for D1 did not respond to a request for comment from Insider.

How could this impact Jordan?

It is unclear whether Jordan has personally invested with Melvin or D1, but the GameStop and AMC trading surges have hit his deep-pocketed partners just as basketball faces a squeeze of its own.

Melvin’s spokesperson did not comment on whether Plotkin was considering divesting in light of this week’s stock market losses, but a person familiar with Sundheim’s thinking said he would not sell his stake. Representatives for the Hornets and the NBA did not immediately respond to requests for comment from Insider.

The NBA’s bottom line has taken a serious hit from the Covid-19 pandemic. Revenue for the 2019-20 season dropped 10% to $8.3 billion, according to ESPN, with ticket losses accounting for $800 million in losses. The revenue drop for the 2020-21 season could be as high as 40% or $4 billion.

The NBA successfully held playoffs in a bubble at Disney World this past summer, but the 2020-21 season, which is outside a bubble, is off to a rough start. Multiple games have been canceled due to teams not having enough players because of Covid-19 cases and injuries. If NBA teams cannot hold 72 games this season, millions in TV money could be at stake.

Jordan’s approximate 70% stake in the Hornets accounts for almost half of his $2.1 billion net worth, according to Forbes.

Cohen is another hedge fund founder and sports team owner whose firm took a hit this week. Point72, founded by the New York Mets owner, was an investor in Melvin Capital and lost nearly 15% when GameStop shares rallied, according to the New York Times.

The billionaire has commented on the stock market volatility on Twitter. “Rough crowd on Twitter tonight,” he tweeted on Tuesday. “Hey stock jockeys keep bringing it.”

Cohen followed up today with, “I’m not feeling the love on this site today. Trading is a tough game. Don’t you think?”

Not all basketball billionaires are losing money

Mark Cuban, the billionaire who owns the NBA’s Dallas Mavericks, has rejoiced at this week’s events. “I got to say I LOVE LOVE what is going on with #wallstreetbets. All of those years of High Frequency Traders front running retail traders,now speed and density of information and retail trading is giving the little guy an edge,” he tweeted yesterday. “Even my 11 yr old traded w them and made $”

Chamath Palihapitiya, the billionaire venture capitalist who has a stake in the Golden State Warriors, bought GameStop call options and sold them for a profit, which he says he will donate to David Portnoy’s Barstool Fund. He argued against the view that he and day traders were unwise to drive up GameStop’s stock.

“Let’s look at Tesla. Who was right on Tesla? I’ll tell you who was right: every single retail investor. I was right. Elon Musk was right,” Palihapitiya said on CNBC on Wednesday.

“The point is: just because you’re wrong, doesn’t mean you get to change the rules … Especially [since] when you were wrong, you got bailed out the last time. That’s not fair.”

Source: Read Full Article